Previous & Top of the Series: WorldCom — The Telecom Giant That Billed Us for a Fantasy

🕵️ Grifted: Success That Survives the Scam

Installment 2A: The Energy Empire Everyone Worshipped

🚨 Content Note: This installment opens with a depiction of a real-life suicide. If you or someone you know is struggling, please contact the Suicide & Crisis Lifeline by dialing 988 or visiting 988lifeline.org. You are not alone.

I know this pain firsthand. I lost my father and my best friend from college—Lasse—to suicide. It left holes in my life that will never fully close.

If you’re in that place, you may believe the world is better off without you. You may feel like a burden. I promise you—you are not. Speaking from experience: the people who love you are absolutely better off with you. Always.

Please, keep living. Keep going. Reach out to someone close to you. Say something. Let someone in.

I would give anything to say these words to my dad and to Lasse. I can’t anymore. But I can say them to you.

And I mean them.

You matter.

You are needed.

I’m pulling for you.

Call 988 or visit 988lifeline.org. Help is real. So is hope. ❤️

"The conscience that cracked the mirror"

January 25, 2002.

In a quiet Houston suburb, a silver Mercedes-Benz sat still in the cul-de-sac. Inside was the body of Cliff Baxter, former Vice Chairman of Enron. He had died by suicide, a self-inflicted gunshot wound to the head. A note was left behind, addressed to his wife, and its words carried heartbreak and disillusionment:

“I am so sorry for this. I feel I just can’t go on.”

Baxter wasn’t some fringe player. He was an insider. A true believer. And then, slowly, a haunted one. As the company he helped build twisted itself into a hall of financial illusions, Baxter grew vocal—skeptical, then disillusioned. He’d resigned months earlier, citing concerns about Enron’s direction.

His death shocked the country. Not just because of its tragedy, but because it seemed to confirm what the financial world was only beginning to suspect:

Something was very, very wrong at Enron.

From WorldCom to Enron: A Tale of Two Collapses

If you read our last installment, you know that WorldCom’s July 2002 bankruptcy filing shattered records with $107 billion in assets—at the time, the largest in U.S. history. But what often gets forgotten is that just eight months earlier, Enron held that title.

When Enron collapsed in December 2001, its bankruptcy involved a jaw-dropping $63.4 billion in assets. That’s nearly half of WorldCom’s—yet Enron’s name is the one that endures. In history books, documentaries, pop culture, and the public imagination, it’s Enron—not WorldCom—that became synonymous with fraud, ego, and corporate tragedy.

Why?

Why is the smaller collapse the one we remember? Why is Enron the scandal that still echoes decades later?

Keep reading. Because to understand why Enron haunts us still, you have to meet the people who built it.

😏 The In-the-Know Flex Poll

Do you know the real story behind both Enron and WorldCom?

Be honest… how deep does your scandal savvy really go?

💼 Enron? Of course. WorldCom? Umm… not ringing a bell.

📣 Heard of both—been yelling about them since 2002.

🤯 I knew the names, but this series is melting my brain (in a good way).

🙈 Neither! Should I be embarrassed to admit that?!

👽 I only knew about WorldCom... but us Martian are 🤪 weird like that. 🤷♂️

📣 Stay One Step Ahead with Grifted

Hooked on this story? Hit like, drop a comment, and subscribe now so you don’t miss Part 2B—the dramatic Enron finale.

But Grifted is just the start.

Subscribe to Collaborate with Mark and unlock the full series—from WorldCom’s creative accounting to Theranos’s cult of charisma—plus the deeper lessons linking fraud, leadership, and culture.📘 Want to stay ahead of the curve?

Substack subscribers get exclusive early access to my upcoming book: Collaborate Better: From Silos to Synergy.

Be the first to see previews, behind-the-scenes insights, and subscriber-only content.Join a crew of curious thinkers building something smarter than the last broken system.

💡 Smarter than LinkedIn. Cooler than compliance. Subscribe now.

📈 The Rise

🏛️ The Empire of Hype

At its peak, Enron was the seventh-largest company in the United States. Its market cap soared to over $70 billion. Magazine covers worshipped it. Consultants sold Enron’s culture as a template. Professors preached its strategy.

From 1996 to 2001, Fortune named Enron “America’s Most Innovative Company” six years in a row.

Why? Because Enron wasn’t just an energy company—it was a new philosophy of capitalism.

They were deregulating markets and then creating new ones. In India, Enron led the construction of the Dabhol Power Station—at the time, the largest foreign investment in the country. The $3 billion gas-fired plant was supposed to be a cornerstone of modern energy infrastructure. Instead, it became a symbol of overreach, controversy, and financial failure, ultimately shuttering after Enron’s collapse and later being partially revived by the Indian government under a new entity.

They launched Enron Online, the first web-based energy trading platform. It allowed customers to buy and sell energy contracts in real time, removing traditional brokers and creating what Enron touted as a transparent marketplace. It was flashy, fast—and, in hindsight, frighteningly opaque.

They sold broadband bandwidth, weather futures, and risk as a commodity. One of their boldest plays was the Enron-Blockbuster deal in 2001: a 20-year agreement to stream video-on-demand through Enron’s broadband network. The partnership promised a digital revolution, but quickly crumbled due to poor licensing, faulty tech, and inflated projections. Enron still booked $110 million in imaginary profits from the venture—proof that narrative, not performance, was their true product.

Ironically, just six years later, Netflix turned Enron’s broken promise into reality. Where Enron relied on hype and vapor, Netflix built incrementally—first mailing DVDs, then launching a reliable streaming platform in 2007 that redefined entertainment. Netflix succeeded not because it made big promises, but because it kept small ones until they scaled.

They launched Enron Online, the first web-based energy trading platform.

They sold broadband bandwidth, weather futures, and risk as a commodity.

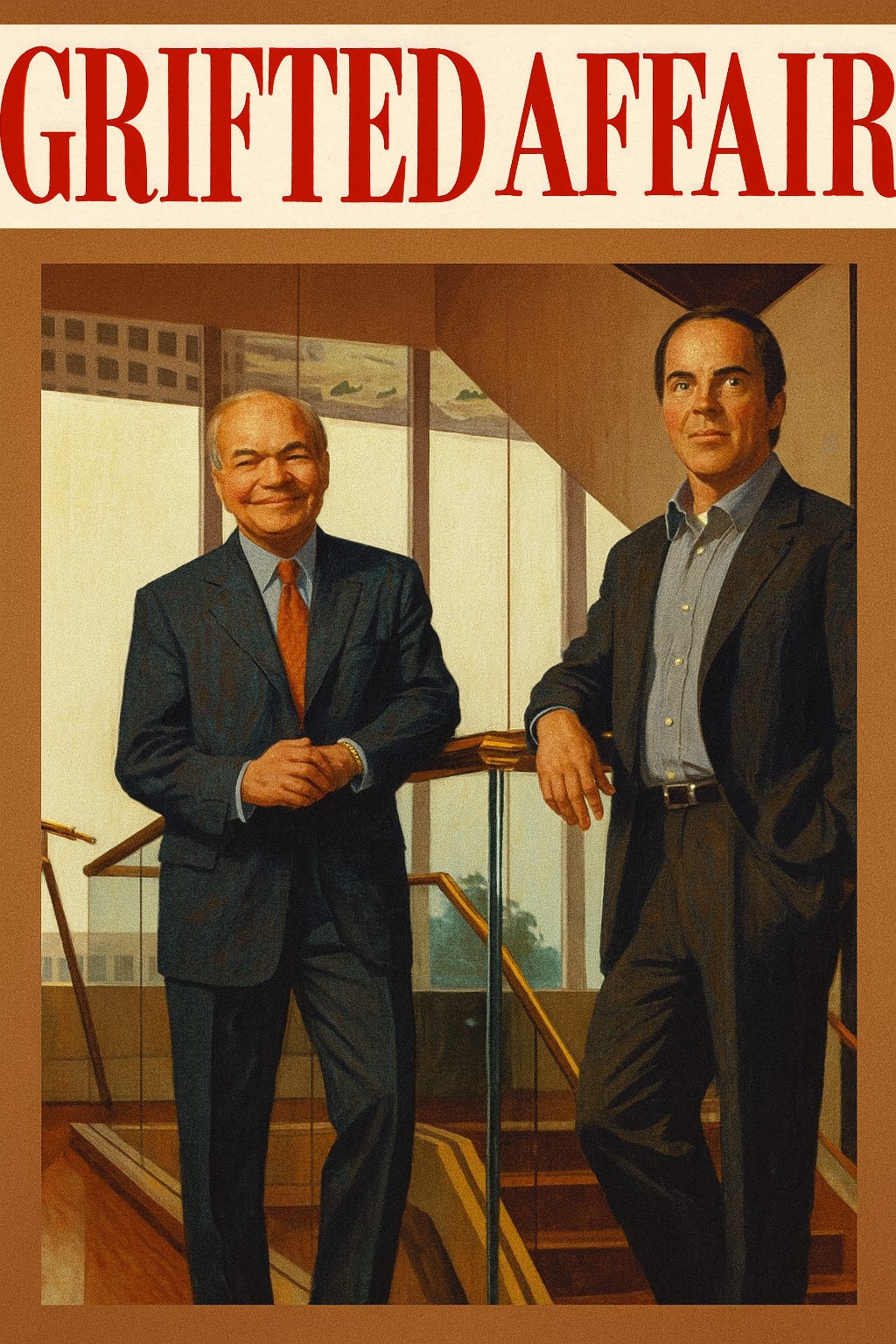

CEO Jeff Skilling proudly referred to Enron as an “intellectual SWAT team.” He didn’t just want to compete—he wanted to rewrite the rules of the game. And for a while, it seemed like he had.

Meanwhile, founder and Chairman Ken Lay played the elder statesman. Folksy, warm, politically connected. He made Enron feel safe even as Skilling made it look brilliant.

It worked. Analysts were spellbound. Journalists mesmerized.

No one could quite explain how Enron made money.

And no one dared admit they didn’t understand it.

🎩 The Cult of the Smartest Guys in the Room

Inside Enron’s glassy towers, a culture of cutthroat brilliance flourished. Skilling instituted a brutal “rank and yank” system: the bottom 15% of employees were fired each year. You survived by being the loudest, boldest, most aggressive believer in Enron’s vision.

It was a place where intellectual arrogance was currency. Doubt was weakness. Questions were for losers.

When an analyst once dared to ask Jeff Skilling why Enron’s finances didn’t seem to add up, Skilling famously shot back:

“Well, thank you very much—we appreciate that... asshole.”

The room laughed. Because being smart meant never having to explain yourself.

This wasn’t just corporate bravado. It was a mystique. A myth.

Skilling and Lay weren’t just running a company. They were cult leaders in Armani suits.

And Cliff Baxter? He’d once been in the inner circle. But even he couldn’t keep pretending forever.

💣 The Lie

🧨 The Cracks Begin to Show

By mid-2001, the glow was dimming.

Baxter resigned in May.

Skilling suddenly stepped down in August, citing “personal reasons.”

Lay returned to the CEO role. Wall Street was puzzled—but still loyal.

In October, Enron announced a $638 million loss and disclosed a $1.2 billion reduction in shareholder equity. It sounded bad.

It was worse than bad.

And inside, Cliff Baxter had seen it all coming.

When the house of cards finally tumbled, it wasn’t just a financial failure. It was a moral collapse.

But we’re not there yet.

Because the full story of Enron’s illusion—its hidden debts, its puppet partnerships, its games of smoke and shadow—belongs to someone else.

A man named Andrew Fastow.

And next week, he takes the stage.

🎭 Poll: Who Do You Think Was Really Pulling the Strings?

Based on what you've read so far, which figure feels most responsible for how this empire was built (and started to crack)?

🧠 Jeff Skilling – The brainiac CEO who rewrote the rules—and maybe reality

👔 Ken Lay – The affable frontman who kept it cozy while chaos brewed

🧱 The Culture Itself – Toxic confidence, silence, and cutthroat loyalty

🪞 The Media & Market – Everyone outside Enron who praised the emperor’s new clothes

🫣 Still Holding Judgment – I need to meet Fastow before I point fingers

📆 Next on Grifted: Installment 2B – “The Greatest Scam Belief Ever Bought”

Next Blog In This Seven Part Series: Enron — The Energy Empire Everyone Worshipped (Part II)

Fastow’s financial wizardry, the unraveling of a giant, and the strange case of Lou Pai—the man who cashed out and disappeared.

🔔 Subscribe now to be notified when the truth behind the curtain is revealed.

Parting thought …

“A few weeks after Baxter’s death, the executives who built this empire would face a different fate—some in prison, one in exile, and millions betrayed. But the true architect of Enron’s darkness wasn’t just Lay or Skilling. That story belongs to brains behind LJM and Chewco—and it begins next week.”

🧾💥 Want to Know What Really Happened Behind the Shredder?

If you're dying to know how Arthur Andersen went from gold standard to ghost story—and how Enron didn't just burn the books, but shredded history itself—then you’ll want to read the Subscriber-Only deep dive:

👉 Grifted: The Fall of Arthur Andersen

We’re talking:

The integrity that once built an empire 🏛️

The audit trail that vanished 📉

And the innocent professionals caught in the fallout 💼💔

🔒 But here’s the catch: You must subscribe first to unlock it.

Because some truths? They don’t come freely. They come archived, footnoted, and buried under confetti made from compliance memos.